As New York City continues to grapple with skyrocketing rents and shrinking supply of affordable properties, policymakers should look to existing vacant homes. In this category of vacant homes are 1) pied-á-terre homes, vacant homes that are empty due to speculation, typically in affluent neighborhoods and 2) zombie properties that have been abandoned due to foreclosure. To tackle the city’s affordability crisis, policymakers should enact a tax on vacant properties to discourage long term vacancies and bring in revenue to develop affordable housing.

Racism is ingrained in NYC housing policy and zoning. Redlining, exclusionary zoning, and the 2008 foreclosure crisis targeted Black and Brown communities by selling predatory loans, which created a “wave of abandoned homes” that still exists today, particularly in the outer boroughs. By using funds raised from a vacancy tax to invest in zombie properties, we can begin to restore neighborhoods that have been historically disinvested.

There is an incongruence between neighborhood disinvestment and city and state-wide efforts pushing for development: how can we expand supply while maintaining affordability and providing meaningful investment in our most vulnerable communities? One way is to monitor speculation and pied-á-terre homes. Assemblymember Linda Rosenthal (D-Manhattan) has introduced new legislation to tax vacant properties and mitigate the harms of real estate speculation. The vacancy tax (A04455), similar to legislation in cities like San Francisco and Vancouver (whom CNYCN met with this fall), imposes a tax on vacant residential units and creates a new affordable housing development fund. The following brief will discuss the status of vacant homes in New York City along with the proposed residential vacancy tax.

By Sophie Harrington and Yvette Chen

Policy Brief

Using A Vacancy Tax in NYC to Fund the Restoration of Zombie Homes

The Center for NYC Neighborhoods, The Black Homeownership Project

Introduction: Scope of the Issue

New York City’s housing affordability crisis is the result of a multitude of factors and one of them is vacancy. There is simultaneously the issue of vacant properties that are empty due to speculation, like pieds-á-terre homes, as well as vacant properties that have been abandoned due to foreclosure. In order to tackle the city’s affordability crisis, policymakers should enact a tax on vacant properties to discourage long term vacancies and to bring in revenue to develop new affordable housing.

There is a long history of institutional racism specifically in housing vacancies across Black and Brown neighborhoods, particularly after the 2008 foreclosure crisis created a “wave of abandoned homes” that still exists today (Young 2022). A Furman Center analysis details the worsening housing affordability crisis across the city and advises that policymakers should better regulate the existing housing stock and monitor vacant housing to expand supply (Been et al. 2023). While recent state- and city-wide efforts ambitiously push for more development and expanding supply (Governor Hochul’s now defunct Housing Compact and Mayor Adam’s City of Yes), these efforts must be matched with already proposed legislation that targets existing housing stock. Funding from a residential vacancy tax can help restore zombie homes that have fallen into disrepair and create meaningful investment in communities of color.

Introduction: Scope of the Issue

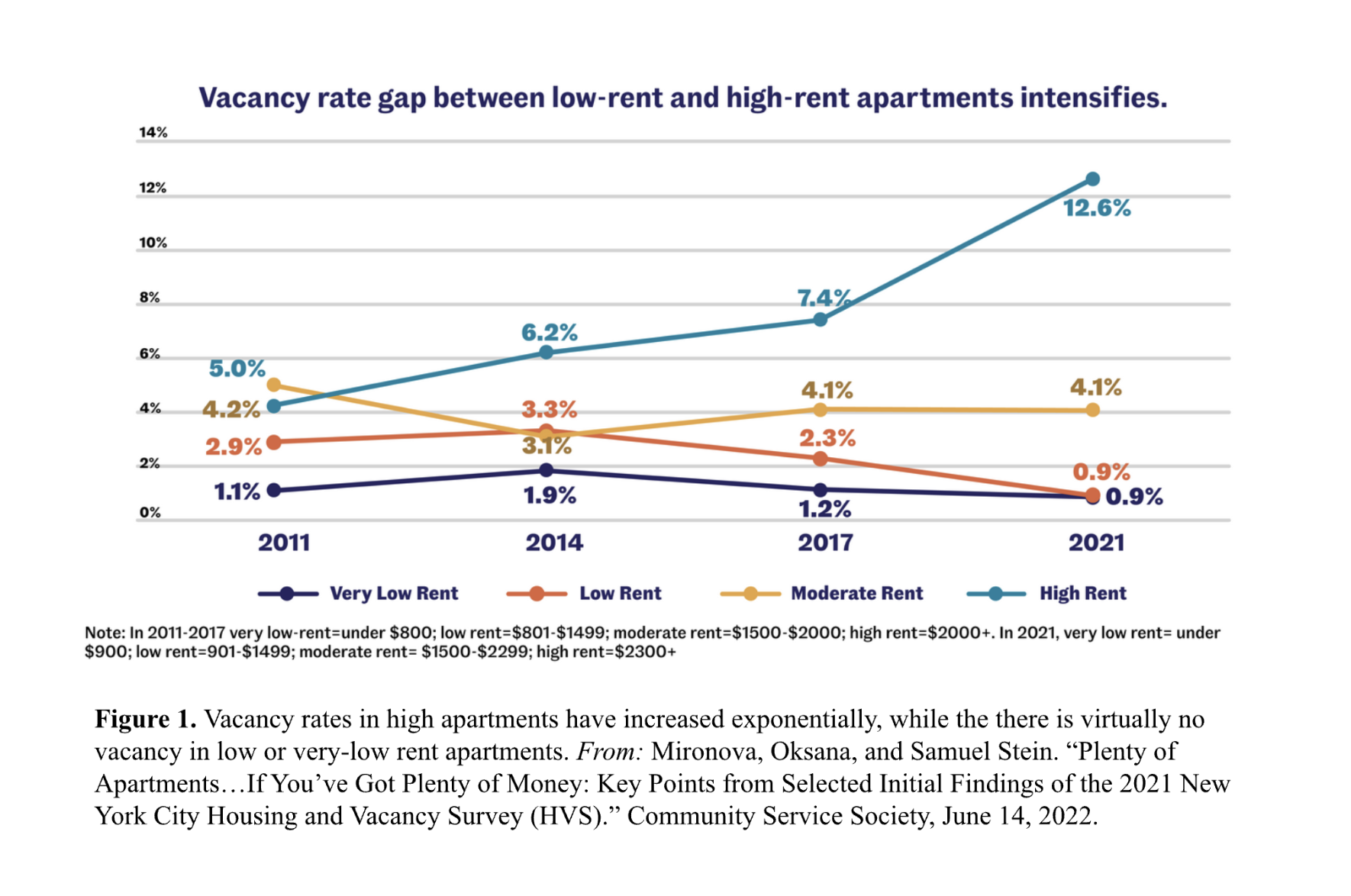

The most recent NYC Housing and Vacancy Survey data from 2021, while impacted by the pandemic-induced exodus from the city, still offers invaluable insights on vacancy rates and housing stock. An analysis of the data by Oksana Mironova and Samuel Stein from the Community Service Society indicates that the vacancies of high-rent apartments is increasing over time (Mironova and Stein 2022). As of 2021, there was a 12.6% vacancy rate for high-rent apartments (many pied-á-terre properties) or apartments renting over $2,300, as shown on the graphic by Mironova and Stein below (Ibid).

Concurrently, vacancies are concentrated in Manhattan, which has an overall vacancy rate of 10% compared to the city-wide rate of 4.5% (Ibid).

Relevant for the application of the residential vacancy tax, which taxes housing that has been vacant for more than 182 days within the tax year, the number of empty apartments for “occasional, seasonal, or recreational use” has increased from nearly 75,000 to over 102,000 (a 37% increase) from the 2017 to 2021 surveys (Mironova and Stein 2023). Comparatively, San Francisco, which passed an Empty Homes Tax last year, has around 10,000 units vacant due for seasonal, recreational, or occasional use according to 2021 data from the US Census Bureau (Budget and Legislative Analyst’s Office).

The underlying ideas of the residential vacancy tax are primarily to mitigate the harms of real estate speculation and incentivize owners to put housing on the market, and secondarily, to raise revenue to help support more affordable housing and community centered programs. Major cities with similar markets to NYC have considered and implemented vacancy taxes, most notably San Francisco and Vancouver. Since the passing of Vancouver’s Empty Homes Tax in 2017, which taxes property owner’s 3% of their home’s assessed value, the city has raised more than $115 million in revenue for affordable housing initiatives (Little 2023). Vancouver’s vacancy tax is also credited for bringing more than 18,000 units back to the rental market since it began in 2017 (Ministry of Finance British Columbia).

Zombie Homes – A Different Type of Vacancy

In addition to high end apartments intentionally left vacant, there’s a more pernicious type of vacancy plaguing NYC: zombie homes.

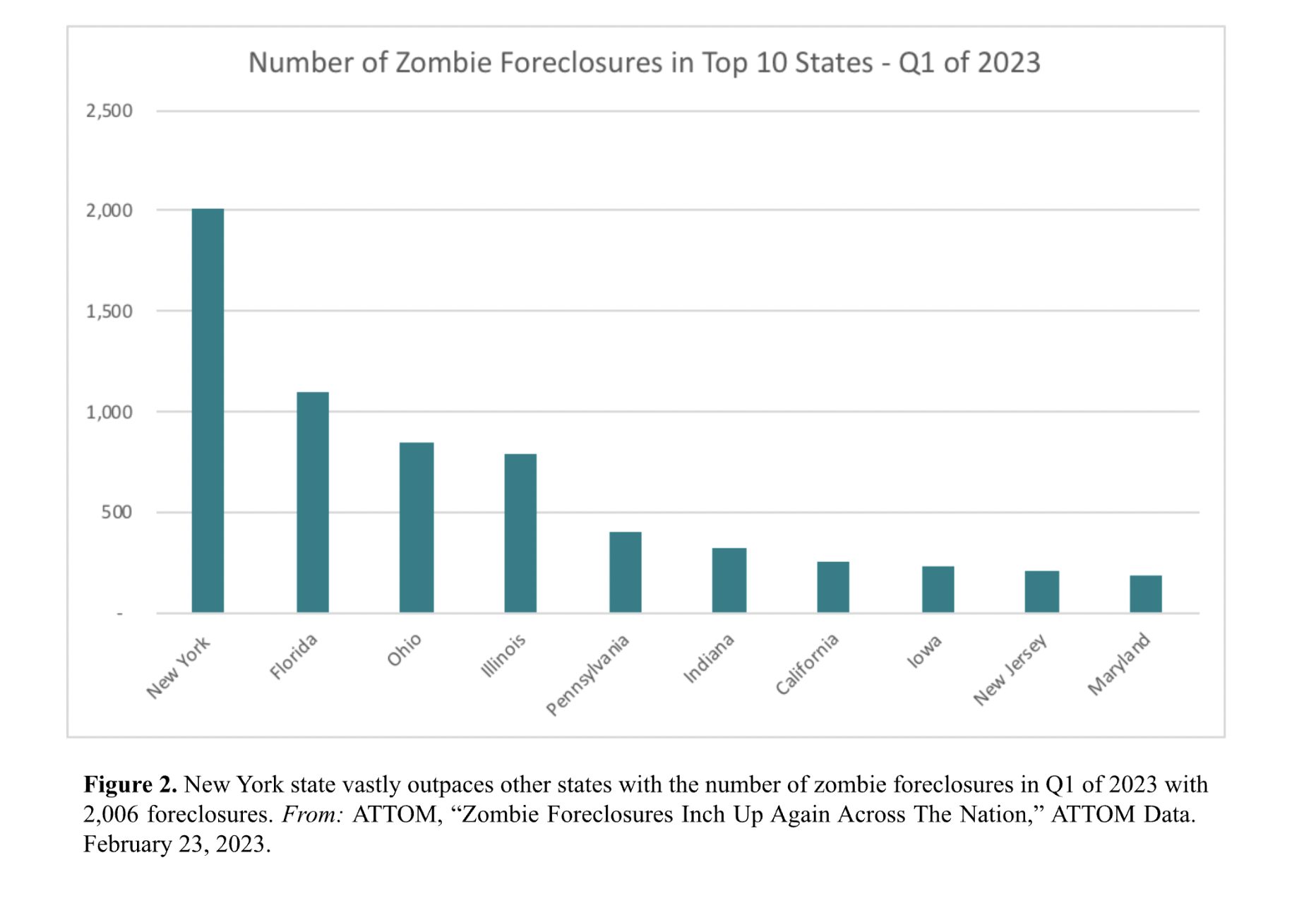

NYC boasts the highest number of zombie properties in the country: more than 2,000 across the five boroughs. These homes are “vacant, deteriorated small homes whose owners are behind on their mortgage payments” and are a by-product of the foreclosure crisis, which predominantly hit low to moderate income Black and Brown neighborhoods (“Neighborhood Planning – Zombie Homes Initiative”). In research collected by the Urban Institute on an analysis of New York’s Zombie Home Law, researchers found that institutional racism in vacancies played into Zombie Home vacancies (Young 2022). “You find a higher concentration of vacant and abandoned properties in neighborhoods of color, and some of that has to do with redlining and exclusionary zoning that perpetuates neighborhood decline” (Ibid). Leading up to the 2008-09 housing crisis, mortgage companies targeted Black and Brown neighborhoods with predatory loans.

Zombie homes not only pose a threat to the individual homeowner, but also can also negatively impact the wider community (Young 2022). Properties adjacent to the zombie home may bear the responsibility of maintenance repairs or else their property could suffer the consequences. For example, if a pipe bursts in an unmaintained zombie property it may leak out of the home and flood neighboring units putting the onus of repairs on neighbors. Vacant and abandoned homes decrease the value of other properties in a neighborhood; this is especially dangerous because these properties tend to manifest in “neighborhoods with lower property values… when the property value is lower, many mortgage lenders and banks would just as soon walk away, leaving local governments and communities to deal with it” (Young 2022). A locally and democratically-controlled fund, raised through the proposed vacancy tax, can help restore individual zombie properties and contribute to the much needed broader community revitalization.

Policy Responses Thus Far

Although policymakers have taken important first steps, more is needed to stop the spread of zombie homes while simultaneously recentering housing development on affordable homes rather than luxury dwellings. The “Abandoned Property Neighborhood Relief Act of 2016” colloquially known as the “Zombie Law,” puts the onus on mortgage holders to inspect, maintain, and report on zombie homes (Weinstein 2016). The Zombie Homes Initiative from NYC’s Department of Housing Preservation and Development catalogs vacant properties (“Neighborhood Planning – Zombie Homes Initiative”) so that shareholders can better understand the scope of the ‘zombie’ homes problem in NYC and to develop strategies to address them (New York Housing Conference).

As a follow up to the “Zombie Law,” in 2018 the Office of the Attorney General enacted the Vacant Properties Remediation and Prevention Initiative which committed $12.6 million to local non-profits in municipalities to assist “in leveraging the Zombie Law” (Caloir et al. 2022). Current Attorney General Letitia James reinvested in this effort by announcing “$9 million in grants to address the growing statewide issue of zombie homes” to provide funding to municipalities across the state (“Attorney General James…”). These efforts were successful in reducing the number of Zombie properties, but are impermanent interventions as they have been issued as one-off grants; especially as New York faces the biggest Zombie crisis in the country a permanent stream of funding is needed.

A Promising Legislative Proposal

Assembly member Linda Rosenthal (D-Manhattan), has introduced a promising new residential vacancy tax (A04455). It follows San Francisco and Vancouver’s examples 1 by imposing a tax

on vacant residential units and creating a new affordable housing development fund. Modeled off of San Francisco’s law, the NYC tax would apply to buildings with six or more separate units that have been vacant for at least 180 days, targeting large landlords and exempting single-family and two- to five-family homes. Under the proposal, NYC would review utility bills, voter registration and other metrics to determine if a property is vacant. This law will bring in needed revenue to build and preserve affordable housing.

However, in order to be effective it must better define the provisions to detect and to find vacancies. In Vancouver, for example, the Collector of Taxes may require an owner to submit several pieces of information to determine vacancy, such as: vehicle registration in British Columbia, income tax returns, tenancy agreements, employment contracts, verification of resident in long term or supportive care, separation agreements, or verification of educational enrolment form among other pieces of evidence (City of Vancouver, 15). Furthermore, it must clarify how or where funds will be directed–especially if it seeks to provide affordable housing.

Policy Recommendations

We propose that the revenue from vacancy tax legislation be dedicated to fund the restoration of zombie homes. One of our biggest priorities is preserving the built environment of NYC neighborhoods, which is why using existing housing developments is of the utmost importance. This is achievable with permanent funding and resources.

Within a year of enactment, vacancy rates will be determined and zombie properties identified – allowing the NYC Department of Finance to issue fines. The revenue will flow into a general fund that will be distributed to the 59 NYC community districts, with first allocations directed to districts with the highest number of zombie properties. Community boards have pertinent experience dealing with land use and zoning issues and are the best advocates for the needs and interests of their neighborhoods, which is why we believe they should be responsible for managing this fund (NYC Mayor’s Community Affairs Unit). It will be straightforward to determine where the highest concentration of these properties exist as the Zombie Homes Initiative already has a mapping tool that identifies zombie properties. This fund will operate similarly to a community land trust (CLT) fund—a social housing mechanism that is already embraced by non-profit developers across the city.

Further, community boards will ensure that local community groups have the right of first refusal on zombie homes in their neighborhoods at a subsidized market rate, with affordability determined by a task force within the community board. This allows community board representatives the opportunity to give local groups a fair shot at buying and renovating the property to convert single-family homes to multi-family units in order to make homeownership more affordable and accessible (Curtin and Bocarsly 2008). Homeownership will be made more affordable when residents can buy-in to a larger property without necessarily having the means to singularly own entire properties; this will help to close the generational wealth gap and will promote thriving neighborhoods. The community boards will then collaborate with local non-profits for each zombie home to determine affordable pricing for ownership shares and the best development plan. The board will invite former residents of zombie homes to participate and have the first buy-in to social housing as a form of restorative justice.

Conclusion

The housing crisis in NYC demands the creation of more affordable housing – which is why we must use existing resources and housing stock. As Vacancy Taxes are implemented across North American municipalities, more data points to how wealthy individuals can be regulated for their unfair use of land and prioritize redistributing funds to low-to-middle income residents who need affordable housing. The proposal of a Vacancy Tax can also provide the type of regulated, and consistent flow of funding needed to support the redevelopment of affordable homes that will house New Yorkers who face housing insecurity. We also seek to restore land to the long standing communities and longtime residents in the neighborhoods besieged by gentrification, displacement and disinvestment. We must preserve and create affordability, discourage housing speculation, and encourage thriving neighborhoods by providing access to housing for all residents, otherwise we risk succumbing to the Living Dead of Property, zombie homes and vacant pieds-á-terre.

While writing this policy brief, The Center for NYC Neighborhoods corresponded with legislative offices in both San Francisco and Vancouver that have worked on the implementation of their respective vacancy taxes.

Appendix

ATTOM, “Zombie Foreclosures Inch Up Again Across The Nation,” ATTOM Data. February 23, 2023. https://www.attomdata.com/news/market-trends/foreclosures/attom-q1-2023-vacant-prozerty-and-zombie-foreclosure-report/

“Attorney General James Announces Funds to Combat Zombie Homes and Revitalize Neighborhoods.” Https://Ap.Ny.Gov/Press-Release, July 10, 2019. Office of the New York State Attorney General. https://ag.ny.gov/press-release/2019/attorney-general-james-announces-funds-combat-zombie-homes-and-revitalize.

Been, Vicki, Jiaqi Dong, and Hayley Raetz. “Critical Land Use and Housing Issues for New York State in 2023 .” Critical Land Use and Housing Issues for New York State in 2023 . NYU Furman Center, 2023. https://furmancenter.org/nyshousing2023.

Budget and Legislative Analyst’s Office, City and County of San Francisco Board of Supervisors, Policy Analysis Report Re: Residential Vacancies Update, October 20, 2022, https://sfbos.org/sites/default/files/BLA.Residential_Vacancies.Update.102022.pdf

Caloir, Helene, Joe Schilling, David Greenberg, and Elizabeth Champion. “Reclaiming Vacant Houses & Preventing Foreclosure.” New York: LISC & Urban Institute, March 2022. https://www.lisc.org/our-resources/resource/reclaiming-vacant-houses-preventing-foreclosure/.

City of Vancouver, British Columbia, Vacancy Tax By-Law, “Vacancy Tax By-Law No. 11674,” November 1, 2023, 15, chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://bylaws.vancouver.ca/11674c.PDF.

Curtin, Julie Farrell, and Lance Bocarsly. “CLTs: A Growing Trend in Affordable Home Ownership.” Journal of Affordable Housing & Community Development Law 17, no. 4 (2008): 367–94. http://www.jstor.org/stable/25782829.

Little, Simon. “Cut Vancouver’s Empty Homes Tax Back to 3% for 2023, City Staff Recommend – BC | Globalnews.Ca.” Global News, May 4, 2023, sec. Politics. https://globalnews.ca/news/9674737/vancouver-empty-homes-tax-cut/.

Ministry of Finance British Columbia, Speculation and Vacancy Tax: Annual Mayors Consultation Technical Briefing, 2020 Tax Year, chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://news.gov.bc.ca/files/SVT_Annual_Mayors_Consultation_Technical_Briefing_2020.pdf.

Mironova, Oksana, and Samuel Stein. “Our Fast Analysis of the 2021 New York City Housing and Vacancy Survey.” Community Service Society, October 12, 2023. https://www.cssny.org/news/entry/our-fast-analysis-of-the-2021-new-york-city-housing-and-vacancy-survey.

Mironova, Oksana, and Samuel Stein. “Plenty of Apartments…If You’ve Got Plenty of Money: Key Points from Selected Initial Findings of the 2021 New York City Housing and Vacancy Survey (HVS).” Community Service Society, June 14, 2022. https://www.cssny.org/news/entry/plenty-of-apartments-if-youve-got-plenty-of-money-2021-hvs-findings.

“Neighborhood Planning – Zombie Homes Initiative.” Government. NYC Housing Preservation & Development. Accessed November 14, 2023. https://www.nyc.gov/site/hpd/services-and-information/zombie-homes-initiative.page.

New York Housing Conference. “HPD Zombie Homes Initiative.” Non-profit. Accessed November 14, 2023. https://thenyhc.org/projects/hpd-zombie-homes-initiative/.

NYC Mayor’s Community Affairs Unit. “About Community Boards.” Government. NYC Government. Accessed November 14, 2023. https://www.nyc.gov/site/cau/community-boards/about-commmunity-boards.page.

Weinstein, Helene. Establishes the “Abandoned Property Neighborhood Relief Act of 2016”; relates to the duty of the mortgagee or its loan servicing agent to maintain property secured by a delinquent mortgage., Pub. L. No. A06932A (2016). https://assembly.state.ny.us/leg/?default_fld=&bn=A06932&term=2015&Summary=Y&Memo=Y.

Young, Caitlin. “Lessons from New York’s ‘Zombie Law’ Can Help Cities Avoid the Risks of Vacant Homes | Housing Matters.” Non-profit. Housing Access and Stability, Housing Matters at the Urban Institute (blog), April 20 20222. https://housingmatters.urban.org/articles/lessons-new-yorks-zombie-law-can-help-cities-avoid-risks-vacant-homes.