In a previous blog post, we showed how nearly a decade after the Great Recession many black homeowners in the city owe more on their mortgages than their property is worth. Homeowners in these “underwater mortgages” are unable to begin to build wealth and are more likely to end up in foreclosure.

This time, we’ve taken a look at home sale prices, again finding stark racial and ethnic disparities. In this case, prices have rebounded since the recession in majority white and Asian neighborhoods, but not so in majority Hispanic and, most markedly, black neighborhoods. While the luxury market (until recently at least) has been soaring, particularly in Manhattan, and bidding wars regularly break out in gentrifying areas of central Brooklyn and western Queens, other neighborhoods with predominantly black homeowners show values that are below 2004 levels.

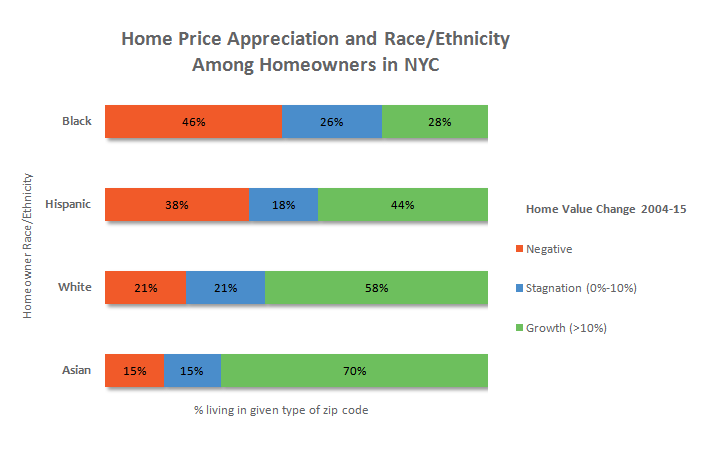

The following chart captures the heart of this story: Forty-six percent of black homeowners live in ZIP codes where the median home value has decreased since 2004. Another 26 percent live in ZIP codes where home values have only marginally increased, giving owners a meager gain in equity for 10 years of ownership.

So what does this mean for housing policy in the city? Homeownership remains one of the best avenues for wealth creation; however, there is a tension between affordability and equity accumulation. When property values in a neighborhood rise too quickly, it can lead to speculation and displacement of longtime residents. But when property values crash and then rebound slowly, as in neighborhoods like Wakefield in the Bronx and Jamaica, Queens, many homeowners struggle to pay their mortgages and are unlikely to have the option to move, even if they wanted to.

These patterns in predominantly black homeowner neighborhoods, and to a lesser degree in Hispanic majority neighborhoods, did not develop in a vacuum. Starting in the 1930s, extensive redlining by the federal government effectively stopped lenders from issuing mortgages in predominantly non-white neighborhoods. Redlining was followed by racial steering and blockbusting that largely determined where non-whites were able to purchase homes. Later, with the arrival of blacks and Latinos, those areas –including southeast and central Queens, central and eastern Brooklyn, and much of the Bronx — were part of the national “white flight” phenomenon, with corresponding municipal disinvestment as neighborhoods shifted.

Today, homeowners in these same neighborhoods are struggling to get reasonable loan modifications and stave off foreclosure. Through its network of over 30 community-based partners, the Center has helped coordinate free, high-quality housing counseling and legal services for hundreds of those residents through the New York State Attorney General’s Homeowner Protection Program.

So what can policymakers do to support stable and affordable homeownership for these households in the years to come?

For one, it’s time for widespread principal reduction modifications by Fannie Mae and Freddie Mac. The majority of housing economists believe that principal reduction is the most effective solution for resolving mortgage distress for underwater homeowners. While the Federal Housing Finance Agency, which oversees those quasi-governmental institutions, has announced plans to implement a principal reduction pilot that will serve a very small portion of underwater homeowners, details on the program are not yet public and it’s unclear how New York City homeowners may benefit.

In the meantime, the Center, through its affiliation with the Coalition for Affordable Homes, has been advocating for city and state funding to purchase distressed mortgages at a discount and to pass on the write-downs in the form of principal reduction. Unfortunately, the Federal government has, for the most part, focused on selling distressed mortgages to deep-pocketed investors seeking to maximize profit.

Image credit: Flickr / Marques Stewart

Chart Sources: DOF Rolling Sales, Census ACS 5-year estimates 2010-2014. ZIP codes for which there were insufficient 1-4 unit home sales data were excluded from this analysis. Those ZIP codes are primarily in Manhattan below 120th street and above 153rd street. Outer borough ZIP codes excluded for the same reason are 11697, 10451, and 11359.